Simon Says: Have “The Talk” with your parents

Contributed to EO by Saul Simon, a certified financial planner, a registered representative of Lincoln Financial Advisors and founder of Simon Financial Group. This article is the second in a series of three about having “The Talk” with your business partners, parents and adult children.

Contributed to EO by Saul Simon, a certified financial planner, a registered representative of Lincoln Financial Advisors and founder of Simon Financial Group. This article is the second in a series of three about having “The Talk” with your business partners, parents and adult children.

As we get older and hopefully wiser, more responsibilities fall upon us. We are often referred to as the Sandwich Generation—caught in the middle between aging parents and children.

We, as children of aging parents, have to look toward the future, and with that comes the delicate “talk with our maturing parents” (and/or senior relatives who may not have children or other involved family).

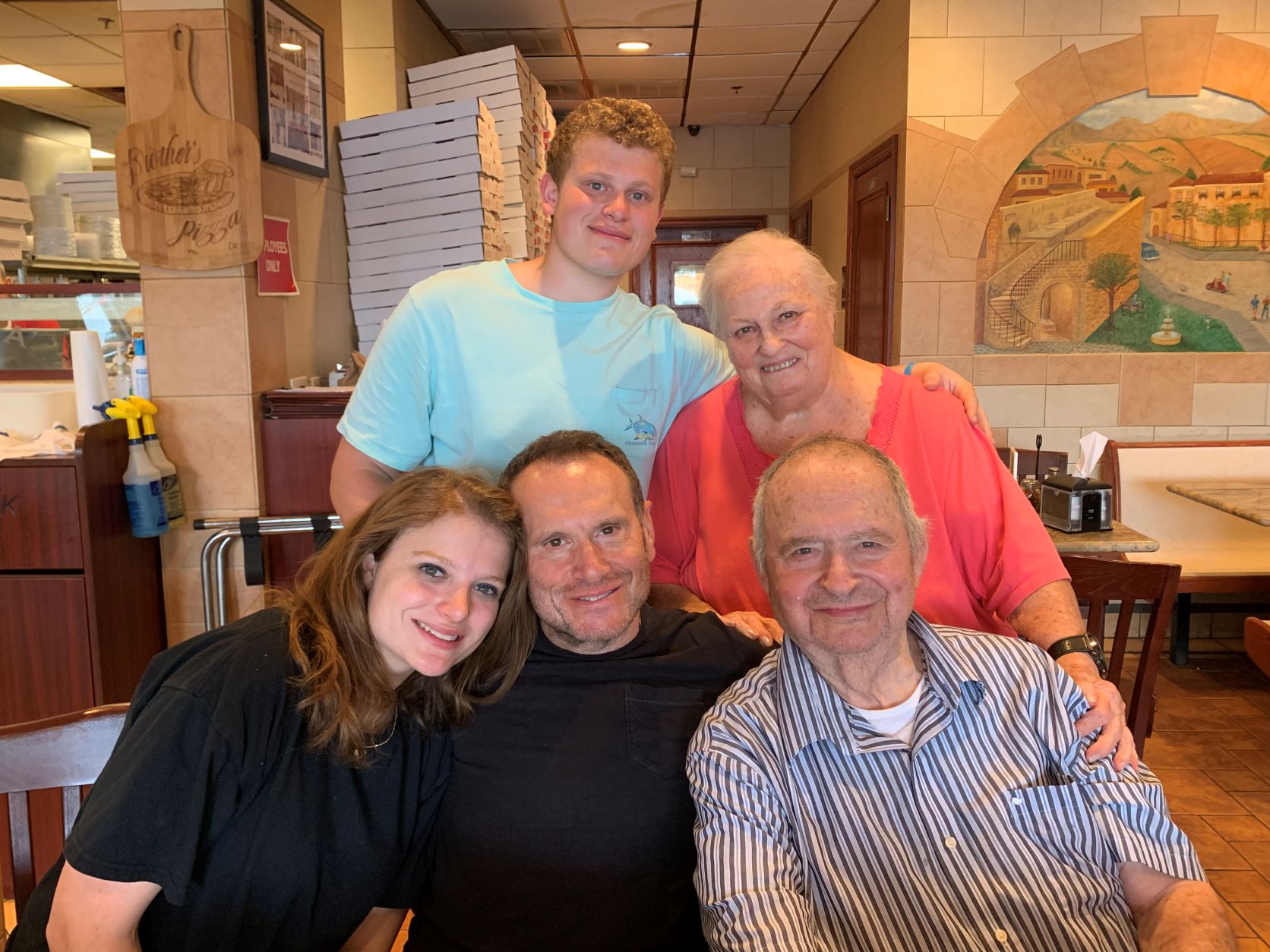

Brace yourself—this may not be easy for you to do or for your parents to hear, but to avoid serious issues in the future which could make a difficult time even more frustrating, this talk is necessary. It goes without saying, this conversation should not happen at a family birthday party, anniversary, Thanksgiving, or holiday celebration. It is very personal and should be scheduled at a quiet time when you, your parents, and any siblings are all together.

Setting the scene

This is a conversation that comes from a place of love and caring. It is meant to fulfill your parents’ wishes for the distribution of their most valuable and precious belongings. In addition, it will enable you to distribute their valuables and sentimental belongings to whom they want, when they want, and in the manner they want. The intention is also to create asset protection strategies so creditors, predators or ex-family members, cannot access the monies that your mom and dad worked so hard to accumulate.